Client Satisfaction Research 2009-2010

Table of contents

Prepared by: Ipsos Reid Corporation

Contract #: 94001-090009/001/CY

POR #: 103-09

June 2010

Client Satisfaction Research 2009-2010

Prepared by: Ipsos Reid Corporation

Contract #: 94001-090009/001/CY

POR #: 103-09

June 2010

Executive Summary

Ipsos Reid was commissioned by the Canadian Transportation Agency to conduct client satisfaction research directly related to the Government of Canada's management framework on results for Canadians. Research findings are intended to support the government's initiative on client-centred service delivery, and also lead to better quality information for parliamentarians about the Agency's programs and results.

Background and Objectives

Ipsos Reid was commissioned by the Canadian Transportation Agency to conduct client satisfaction research directly related to the Government of Canada's management framework on results for Canadians. Research findings are intended to support the government's initiative on client-centred service delivery, and also lead to better quality information for parliamentarians about the Agency's programs and results.

Methodology

Ipsos Reid was commissioned by the Canadian Transportation Agency to conduct client satisfaction research directly related to the Government of Canada's management framework on results for Canadians. Research findings are intended to support the government's initiative on client-centred service delivery, and also lead to better quality information for parliamentarians about the Agency's programs and results.

Further to these broader goals, the research is also designed to support the Agency's 2008 Management Accountability Framework assessment undertaken by Treasury Board, where the Agency was encouraged to measure client satisfaction and to set service standards and measure its performance relative to them. The establishment of baseline data on client satisfaction is also an important element of the Treasury Board Secretariat's Service Improvement Initiative.

Internally, client satisfaction has been identified by the Agency as a key element of its Strategic Plan for 2008–11. As such, client satisfaction research is to be used to input into a continuous improvement process for enhancing dealings with the Agency's clients and stakeholders. It will allow the Agency to measure progress on its key strategic priority of enhancing internal and external relations through clear and timely communications. It will also provide insight that will assist the Agency in achieving its other strategic priorities: effective dispute resolution and economic regulation; a more accessible transportation network without undue obstacles to the mobility of persons; and organizational support and responsiveness through superior business management practices.

Target audiences and the research methodologies being utilized to capture data for each audience are summarized below:

- An online survey with passengers with travel-related complaints (including persons with disabilities) – target of n=200 completed quantitative interviews;

- An online survey with those who have been involved in mediations – target of n=40 completed quantitative interviews;

- An online survey of clients relating to adjudicated disputes and determinations involving more than one party – target of n=30 completed quantitative interviews;

- An online survey of clients relating to authorities granted by the Agency involving only one party (except those involving travellers, including persons with disabilities) – target of n=140 completed quantitative interviews;

- An online survey of clients relating to inquiries and requests for information – target of n=250 completed quantitative interviews;

- In-depth qualitative telephone interviews with major service providers – 25 completed quantitative interviews;

- In-depth qualitative telephone interviews with senior officials – 25 completed quantitative interviews.

This report includes both the qualitative research and quantitative research conducted by Ipsos Reid on behalf of CTA for fiscal year 2009-2010.

Qualitative research

Two senior level audiences were researched using a qualitative in-depth interview approach: major service providers and senior officials. A total of n=31 in-depth qualitative interviews were conducted by telephone between March 2nd and April 9th, 2010.

The Agency provided Ipsos with sample contact details (name, organization, job role, telephone numbers). Ipsos then arranged and conducted in-depth interviews with major service providers and senior officials. No incentives were paid to this group. Appointments for interviews were scheduled and carried out by executive interviewers who have comprehensive experience in conducting elite and/or sensitive interviews.

All clients contacted for the research were sent an advance letter on behalf of the Canadian Transportation Agency, informing them that they could be contacted to take part in an interview. Prior to being interviewed, respondents were assured that responses would be reported in aggregate, and that their individual comments would not be identifiable.

A total of n=18 in-depth interviews with major carriers, and n=13 with senior officials were conducted between March 2nd and April 9th, 2010. Each interview lasted between 30 minutes and one hour. All 34 stakeholder contacts on the sample provided by the Agency were contacted for the purposes of this research. Of those, only four did not take part in an interview. In some cases identified subjects no longer worked in the position identified in the sample; in these cases, their successors were asked to participate, where appropriate.

Quantitative research

During fiscal year 2009/2010, the CTA developed surveys to collect feedback from clients on six processes using a paper-based survey. During that same year, the CTA fielded two of the six surveys (mediation and facilitation) using a paper-based publication/methodology. On behalf of the CTA, Ipsos Reid combined all 6 paper questionnaires into one bilingual online survey instrument. For the remainder of the year, Ipsos fielded the mediation and facilitation surveys online and combined the paper and online data sets to produce the analysis contained in this report.

On April 22, 2010, the CTA emailed invitations to the sample as described in the table below using unique links provided by Ipsos Reid. The survey will remain open indefinitely. The first wave of the 2010/2011 fiscal year study among all six audiences will launch in late June 2010.

The table below provides a breakdown of the 2009-2010 fiscal year sample universe, the online outgo, the number of partial and full completes and the full sample size that was analyzed to produce this report.

| Survey Type | Survey Universe | Total Online Out-go | Total Completes (Paper/Online) |

Total Partial Completes (Online) |

Total Sample Analyzed (Paper/Online) |

|---|---|---|---|---|---|

| Mediation | 38 | 13 | 9 | 0 | 9 |

| Facilitation | 264 | 116 | 56 | 7 | 63 |

The quantitative sample consists of a total of n=63 facilitation surveys and n=9 meditation surveys. Due to the small number of completes for the meditation survey (n=9), the analysis of the results is qualitative in nature.

Key Findings

Qualitative research

Overall, key stakeholders are positive about CTA staff and processes; the Agency is described as an institution that demonstrates an "open willingness to address issues and find resolution." Along with the many positive comments and praise for specific processes and Agency departments that this research uncovered, there were also a range of specific suggestions for improvement. These were offered by respondents in the spirit of cooperation and, in the majority of cases, were tempered by an overriding sense of goodwill toward the Agency.

"Really it is just about procedure and process, predictability and fairness, and they make any regulated group happy."

"They are very cooperative on meeting, and they are honest and open and you get real answers to real questions. When you ask a question you hear the truth. You might not like what you hear but it is the truth. Clearly they care."

"[We] appreciate the treatment and response we get from [the Agency] as a regulator and it reflects on the people there. The Agency has built on their knowledge, and they are truly an asset for regulating this industry in Canada."

Multi-Sector Issues and Themes

Dialogue and Communication

Industry and association executives alike are generally satisfied with the level of dialogue they have with Agency executives and staff; there were, however, some respondents who felt that opportunities for dialogue, both formal and informal, could be increased. An encouraging finding is that those stakeholders who had a positive viewpoint on Agency dialogue and access are drawn from across all the groups included in this research. This demonstrates that there are no significant service gaps among specific groups in this regard, or any evidence to suggest that some stakeholder types are currently being better served than others.

Agency Staff

Respondents are generally extremely positive in their assessment of the Agency personnel that they interact with on a day-to-day transactional basis. Agency staff are perceived to be approachable, courteous, helpful, and flexible. Among those stakeholders whose information requests or interactions are more policy based, such as association executives, the information gathering and exchange that they regularly share with their Agency contacts was almost always characterized as being fruitful and positive. Staff turnover, and the potential for a loss of institutional memory, was however a concern for some respondents.

Dispute Resolution

Overall, respondents are enthusiastically embracing alternate dispute resolution processes. Facilitation is well-regarded by transportation operators and other stakeholders, and the Agency is seen as doing an effective job of facilitating this dispute resolution process. Furthermore, stakeholders encouraged the Agency to facilitate this type of dispute resolution more often. Mediation earns even higher praise from respondents, and the Agency was commended for the amount of resources they have allocated to this process; this is seen to be successful in part because of the Agency's commitment to it.

Although it is viewed as time-consuming and expensive, the FOA process is generally considered to be fair, and to produce results. The inevitability of an arbitration ruling is seen to force movement on both sides of an issue. Among the transportation providers, most of whom have legal staff in-house, a formal decision made by a panel of Agency Members is a process that - though perceived to be long, rigorous and expensive - is relatively well-received. As this is quasi-judicial in nature, it is understood that the process has to satisfy the law.

Impartiality

The Agency is a quasi-judicial body tasked with, among its other roles, rendering decisions on disputes between the transportation carriers and their users. It will perhaps come as no surprise that a number of respondents question the Agency's impartiality. There were stakeholders from both sides of various issues – shippers and carriers, consumers and airlines – who felt the Agency was slanted toward their opponents. Some respondents even admitted their own bias in considering the Agency's impartiality. However, when considering the totality of the responses on the question of Agency impartiality it is likely that the Agency is, at present, maintaining a relatively good balance in the eyes of its stakeholders overall.

Accessibility and Accommodation

Accessibility and accommodation issues are a hot button for the airline industry at present, though the rail and marine passenger industries are also affected by CTA decisions on this front. The January 2008 Agency One-Person-One-Fare Policy, followed by the February 25th, 2010 ruling on allergies have raised concerns among some that the Agency is acting more as a consumer advocate than an impartial quasi-judicial body on the accessibility file, and is not considering the true financial hardship these decisions have on the industry when they are compounded over time. On the other side of the coin, advocates for people with disabilities applaud those decisions, and question carriers' reluctance to embrace accommodation, which they view as a human right.

Railway Industry

Because Canada's railway industry has only a few carriers, normal market forces that govern supply and demand in most industries do not apply, making the CTA's role all the more critical. Shippers and carriers alike understand the ramifications of this captive market, both groups acknowledge that intervention is necessary, and believe that the Agency regulates their industry relatively well. Key challenges identified by respondents include concern about the consistency of Agency rulings, which affects stability and therefore the ability to procure capital investment necessary for growth; the Cost of Capital publication/methodology review; and the importance of the first decision on noise.

Airline Industry

There is no bigger issue for the airline industry at this time, specifically in reference to the role of the CTA, than rulings on accessibility and accommodation. Other key challenges – and opportunities - include recovery from the recession and a return to growth, and the new global competitive environment. Overall, airline industry executives have a positive view of the CTA, and believe they do an effective and efficient job of regulating their industry. As well, many CTA administrative divisions receive high marks for approachability and efficiency, including the teams that administrate permits, certificates, and licenses; the tariff administration group, the air travel complaint administration, and the international agreements team.

Marine Industry

Respondents involved in the marine industry seemed to have the least interaction with the Agency: one of the executives interviewed did infer his legal staff had somewhat more regular contact. However, the sample provided for this sector was very small, and may not necessarily be reflective of the industry as a whole. Those interviewed believe the Agency to be responsive when contacted. The key issue for ship owners in relation to the CTA is the erosion of the coasting trade; the industry is also concerned about fleet renewal, pilotage fees, and the impact of U.S. regulatory initiatives.

Quantitative research

Dialogue and Communication

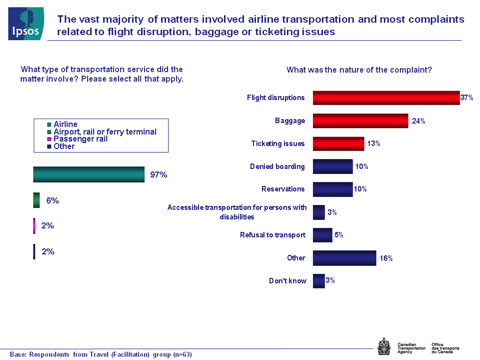

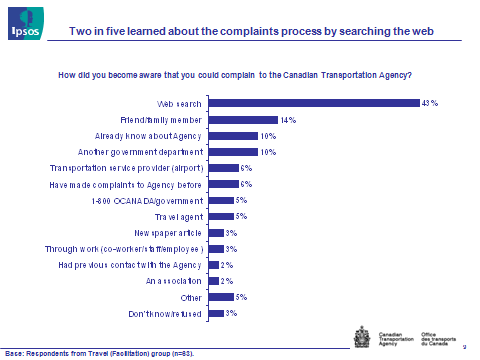

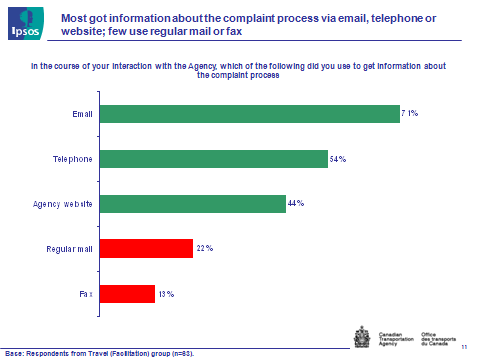

The vast majority of facilitation matters involved airline transportation (97%). Complaints were most often related to flight disruptions (37%), publication/baggage (24%), or ticketing issues (13%). Over two in five respondents (43%) learned about the complaints process through a web search. In the course of their interaction with the Agency, most respondents (71%) got information about the complaints process through email, about half over the phone and 44 percent - from the Agency's website.

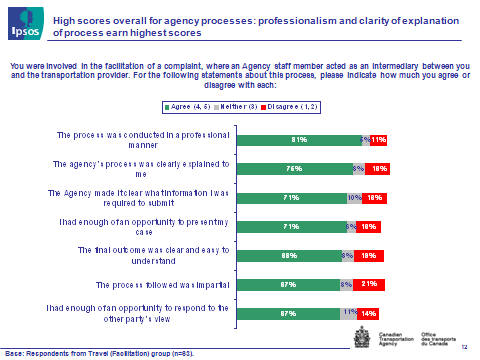

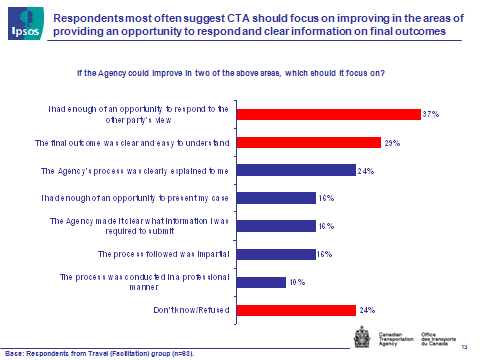

When asked to rate a range of agency processes, respondents provide high scores across the board. Professionalism (81% agree that the process was conducted in a professional manner) and the clarity of the explanation of the process (75% agree that the Agency's process was clearly explained to them) received the highest scores. However, when asked which two areas should be areas of focus for improvement, 37% say they would like to have more opportunity to respond to the other party's view and 29% say the final outcome could be more clearly explained.

Customer Service

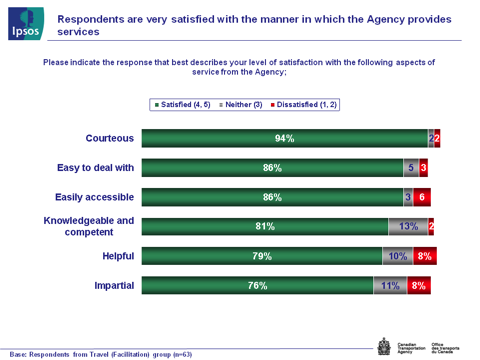

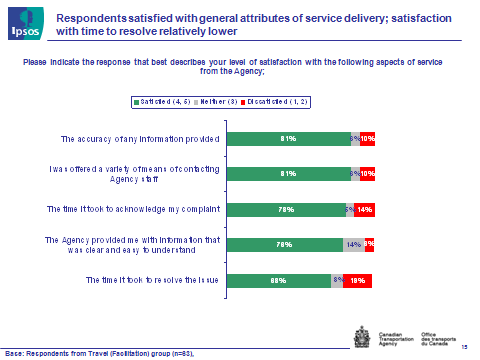

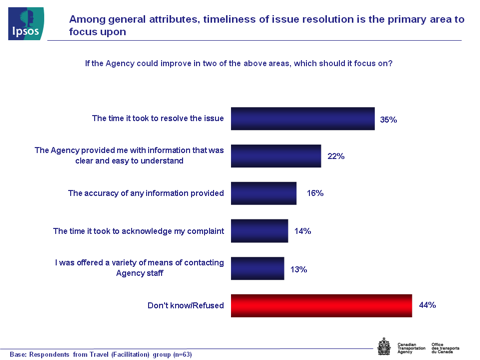

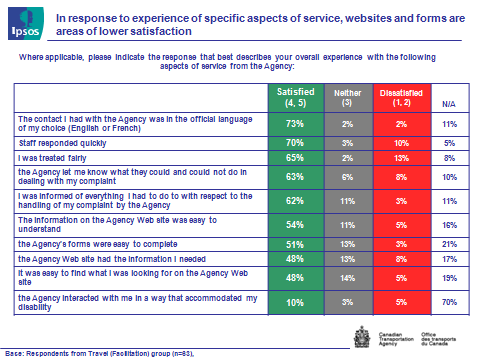

Respondents provide very positive ratings of all service attributes from ease of access to courteousness of the Agency staff. While 68% were indeed satisfied (4 or 5 on a five-point scale) with the time it took to resolve their matter, this service aspect received the fewest positive ratings. Not surprisingly, the time it takes to resolve matters is identified by 35 percent of respondents as an area for improvement along with providing information that is clear and easy to understand (22%).

When asked to rate more specific aspects of service including the Agency's website, fairness, responsiveness, official languages and information about the process, respondents offered very positive ratings. Two in five (37%) could not identify any areas for improvement, though 21 percent identified either improving the ease with which information can be found on the website or providing information about what could or could not be done through the complaints process.

The Complaint/Facilitation Process

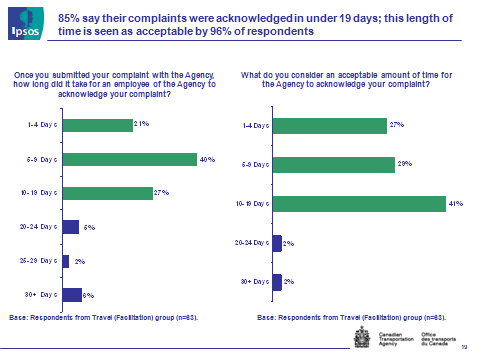

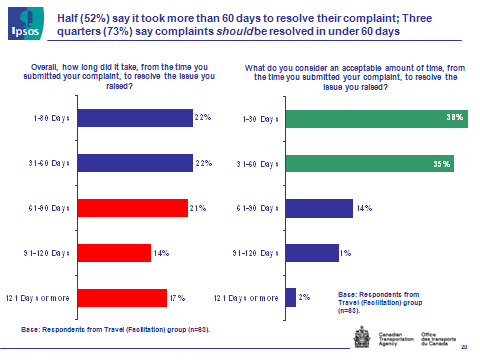

Over four in five (85%) respondents say their complaints were acknowledged in under 19 days; this length of time is seen as acceptable by 96% of respondents. Half (52%) say it took more than 60 days to resolve their complaint(s). Three quarters (73%) say complaints should be resolved in under 60 days.

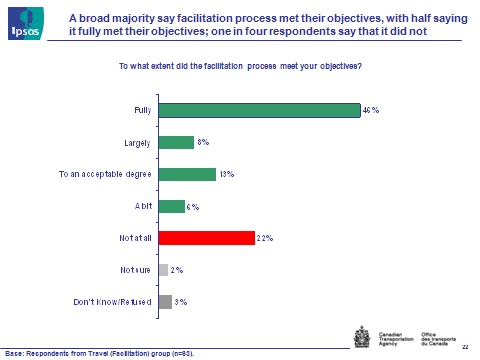

A broad majority of respondents say that the facilitation process met their objectives (67%), with half saying it fully met their objectives (46%) and one in five (22%) saying that it did not at all meet their objectives.

Satisfaction with the Agency

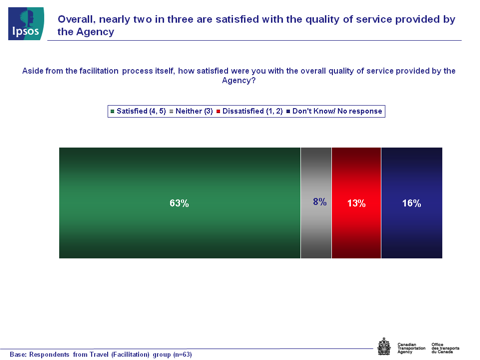

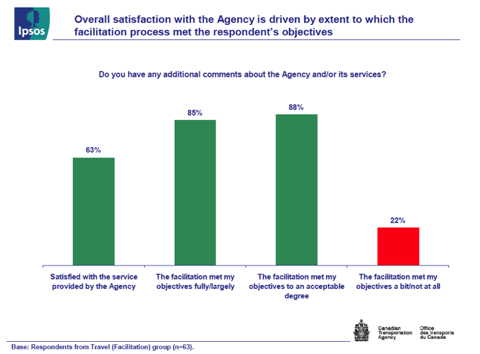

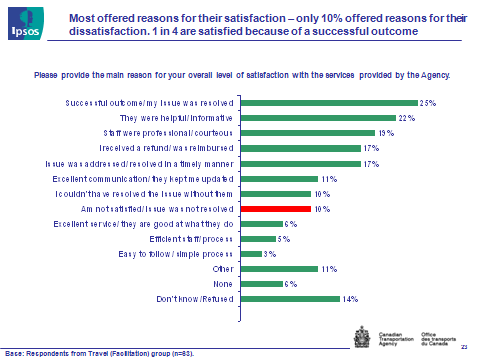

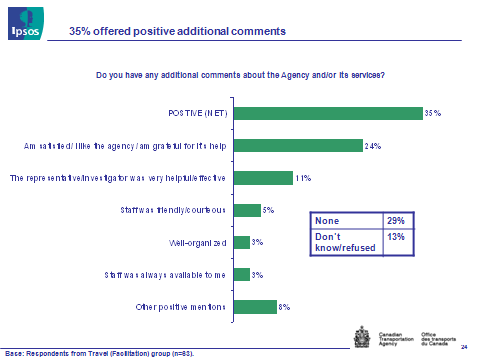

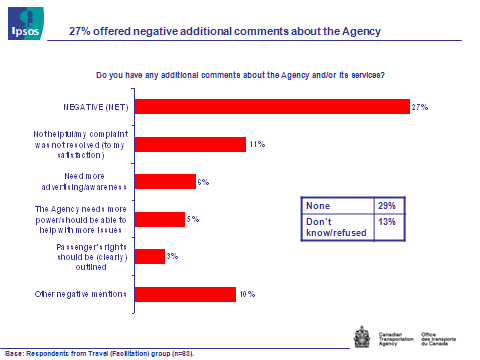

Overall, nearly two in three respondents (63%) are satisfied with the quality of service provided by the Agency. When asked to provide the main reason for their level of satisfaction, most respondents offered explanation. A quarter (25%) cited a successful outcome as the main reason they are satisfied with the Agency. One in ten (10%) say they are not satisfied because their issue was not resolved. While 42 percent did not have any additional comments to offer, 35 percent offered positive comments and just 27 percent offered negative comments.

Detailed Findings: Qualitative Research

Detailed findings of the qualitative research are presented in four sections. The first section explores themes that are universal to the railway, airline and marine industry and to the associations that represent industry and customers alike. These include specific processes and interactions which the Agency has with all its stakeholders, as well as observances about the Agency's role, structure, and relationships that resonate with a wide range of those stakeholders. Respondents were not specifically asked to comment on all of the categories identified here, therefore in some cases only a few respondents highlighted particular issues. As well, some issues that might seem to warrant inclusion are not included if they did not receive mention in the course of the research.

Along with the many positive comments and praise for specific processes and Agency departments that this research uncovered, there were a great number of specific suggestions for improvement to the Agency and its key processes. It is important to temper these comments by stating that in the majority of cases these suggested improvements were offered by stakeholders who value the Agency and its staff; they believe that, overall, the Agency is doing a good job, if not a very good job. Their comments are offered in the spirit of cooperation, and are meant to be recognized as constructive criticisms.

The executives interviewed for this research understand that the stakes are high. But the Agency, in all its complexity, is not expected to be perfect, nor is it ever expected to achieve perfection. Stakeholders want – and need, because the Agency profoundly affects the industries it serves – the Agency to continue to change and to improve to reflect their ever-evolving industries, now and in the future.

"Good, smart people who do their best to balance private and public interests."

"Generally the relationship is fairly positive though we do have good days and bad days. It is a complex relationship but generally good, and when it isn't, there is an open willingness to address issues and find resolution."

"[The CTA's] balance is generally right but the two challenges that could screw it up are transitional manpower and this idea we'll be dealing with more and more complex growth and we really do need to know what is going on or we're going to make regulatory mistakes."

"I'd like to think the relationship we have with CTA is transparent, open and trusting."

Multi-Sector Issues and Themes

Dialogue and Communication

Industry and association executives alike are generally satisfied with the level of dialogue with Agency executives and staff, though there are certainly respondents who felt that opportunities for dialogue, both formal and informal, could be increased. Significantly, those who had a positive viewpoint on the amount of dialogue and access they have with Agency personnel come from all respondent groups identified for this research: associations representing industry, shippers, and consumers as well as industry representatives from the air, rail and marine sectors.

"I know that the agency is always very open and willing to listen to the concerns that we raise and every time I have been involved, whether through a submission, or just picking up the phone they have been eager to listen, to help us understand the process, and been willing to come out and meet with us. We are not wanting for more interaction; the agency has always been there for us."

"The chaps that I deal with, we have come up with our own informal ways of dialoguing by having meetings at the beginning of the year on every assessment. Whenever we have gone to Ottawa with presentations on our new programs the staff has been great in terms of making time for us. We are amazed because they are really busy."

"We have not been doing it for more than a year and we go into the Agency, and have a meeting, and tell them what we see coming and they can't understand if things aren't public, so it's on us to have this dialogue. And it's a good practice, and... they [Agency] have been open and receptive and well attended. Some are initiated by the Agency. Last one it was them and sometimes it was us."

Ongoing dialogue, both formal and informal, is seen to facilitate several key functions. It offers stakeholders and the Agency an opportunity to resolve minor concerns or allay misunderstandings before they can cause larger issues. As well, ongoing dialogue gives stakeholders the opportunity to inform Agency personnel about key industry trends that can affect Agency policy and agenda. When stakeholders are informed of Agency priorities or areas of focus in its upcoming agenda, it affords them planning time and to allocate appropriate resources to those areas. It also gives the Agency the opportunity to explain its own constraints surrounding key issues to stakeholders, which can resolve potential conflicts before they have the chance to develop.

Many stakeholders noted that a mix of informal dialogue and formal dialogue best facilitated open and ongoing communication. Informal dialogue can be achieved by ensuring stakeholders have access to appropriate personnel to discuss ad hoc issues, and formal dialogue could consist of pre-determined – perhaps annual – meetings which would uncover both the Agency's and stakeholders' focuses for the year ahead.

"At the same time there are minor issues or misunderstandings that we bring before these meetings, and that is how we resolve the working relationship and we have used them to address things with the [executives] or the staff. We know where to raise points and we always get someone to hear us and sit down if need me."

"We thought about being more formal about these periodic meetings, to have a semi-annual chit chat. We have a large meeting here [annually] and the CTA is very much a player in terms of setting the agenda and talking about broader industry issues, so that informs them by osmosis and allows them to get up to date. And it's very helpful."

"As far as my membership goes what I can tell you is they make a point of coming here and meeting with the appropriate people and I know my members appreciate it."

"On the issues I deal with we sit down and we talk more and more about these things. And it should be done more often so the [company] can understand. There are things we don't see, their constraints, and those types of communications are very useful."

Many stakeholders called for the Agency to be more proactive in initiating opportunities for dialogue. Though the majority of respondents did feel that the Agency was responsive, both at the staff and executive levels, when requests for meetings or interactions were initiated by stakeholders, there did seem to be some feeling that the Agency could be more proactive on this front. Respondents were well aware that Agency personnel have time and resource constraints, and their expectations are based on an understanding of those limitations. However, increased opportunities for dialogue were an oft-mentioned vehicle for improving Agency functions. Several respondents also noted that having Agency personnel come to their offices, as opposed to their personnel always travelling to Ottawa, could – and did, in some cases where Agency field trips had been conducted – increase the Agency's understanding of their own operational realities.

"You'd like to think the CTA would be proactive but they are not great at that and their workload doesn't allow for that kind of outreach. We have asked for regularly scheduled meetings with the executive...to talk to them about what the impacts of their decisions would be. They seem open to that and I have met with [name] on a number of occasions when I had an acute issue and he has said come on down. It would be great for them to be more proactive and come out and see us. CATSA has done it and it's been beneficial."

"We are often the ones initiating these kinds of meetings and they don't do it a lot and maybe they intend to...but we could have better dialogue and better identification of issues."

"What could be better? Better consultation and more transparency and regular dialogue and ongoing dialogue...when there is a particular issue more proactive and ongoing dialogue would be better so we'd have a heads up when issues were forthcoming."

"A yearly event with stakeholders and the practitioners – those are the guys, the lawyers that work on this stuff, and that call me and ask what the decisions were based on – a yearly event to air your laundry and deal with built up frustration."

"It would be useful for them I think to hold some sessions for stakeholders to discuss how they perceive themselves in making their decisions and what factors they have to take into consideration. Some communication with the shipper stakeholder community to illustrate how they work and what they do - that might be useful. The...senior staff and Board could go out and with a presentation and seminars across the country invite the shipper community to sit down and discuss those issues that are a source of conflict between the railway and them, and talk about how the agency operates as a referee and what their constraints are."

Website

Information presented on the Agency website was generally found to be helpful, up-to-date, and easy to navigate. Respondents were generally very satisfied with the website, and many used it regularly both to keep their own organization informed of Agency decisions and industry news, and also to inform their customers or international partners about rules and regulations governing Canadian transportation.

"I like what you have done on the website, the new tools. This morning for [name, breaking story], you updated the brochure, the licensing search engine you've had for two years and I think these are very good. And we use it to explain the rules in Canada and the Fly Smart shows how we deal with these things. And keep investing in that, and explain the role, and the bulletins."

"I sign on to the website service they have for decisions and I get them and watch them; it's very good."

"We flip the link to the website [to the other carrier], and tell them to talk to "X" at the Agency, but it gives them background and it is a way of explaining. And internally when sending a notice to passengers this is always some language we can use and how we can also explain it. If you have a TA in Ontario or Quebec a regulator has more weight and Fly Smart explains some of the principals. And we...are spending less time trying to....explain it in a clear way for consumers so it's a plus."

Several respondents remarked that the Agency had been asked to revamp the website to better serve a particular communication need and the Agency had complied: this responsiveness was certainly appreciated. One respondent did suggest that on some key announcements, such as the filing of applications, this could also be communicated to interested stakeholders via an e-mail notification system. Another suggestion for improvement came from a consumer advocate group, who suggested that a plain language explanation of key agency decisions could be posted so that consumers could better understand the actual ramifications of decisions affecting them.

"We thought the website could have used some work and they did that so ...I would give them good marks on that."

"One of the problems we have had, and it's only been rectified in the past 8 months, is that there are some provisions in the legislation in which the Agency is supposed to make public - that an application has been filed - but there wasn't a mechanism whereby we were able to determine that without calling and we had to call and they would tell us but it has been rectified now. You get onto the website and they are there and we would have liked something more proactive from them. There isn't a huge list of people that care about this stuff and you could probably put 30 people on it [an e-mail list]."

"At times it is hard for people to understand decisions, and you read it and understanding it is challenging. A plain language version of some of its key decisions, that would be helpful...On key decisions if the agency were to put out an explanatory note on what decisions mean it would be helpful to people in the community. It's fine [as it is] for organizations but not for individuals."

Agency Staff

Respondents are generally extremely positive in their assessment of the Agency personnel that they interact with on a day-to-day transactional basis. Agency staff are seen to be courteous and helpful, and also flexible in, for example, granting extensions to Agency clients on certain types of information requests. Several instances were mentioned of Agency personnel personally reaching out to respondents who were new to a job that involved a lot of Agency interaction, to ensure they understood proper procedure. This not only facilitates a smooth transition when new employees are taking on such roles, but it also sets the framework for a successful, positive working relationship where misunderstandings can be corrected quickly and efficiently simply by picking up the phone. For those stakeholders whose information requests or interactions are more policy-based, such as association executives, the information gathering and exchange that they regularly share with their Agency contacts were almost always characterized as being very fruitful and positive.

"I think very good. My own experience is that they are always very pleasant and courteous and helpful and they grant extensions when we need one. We had one year where employees from CTA came to the office and they were better able to explain how they handled the way claims worked. And that was especially beneficial for new employees and even those who are not aware of their role. Very beneficial and it doesn't have to be often even once a year. They took the time to come over and I thought that helped a lot."

"My first interaction with CTA was great. They understood I was brand new to the role and the CTA person had worked with publication/baggage with us in the past and she wanted to ensure I understood the process. And we had a one hour meeting and she took it upon herself to do that. It was over the phone and she initiated that first meeting. That kind of service was appreciated."

"I know a few key people in the Agency I get information from and honestly I have always found staff to be very courteous and polite and to be as helpful as they can...."

One recurring theme, and area of concern for many respondents, is the perceived loss of institutional memory because of a recent spate of Agency staff turnover. Though respondents readily admitted that these challenges were being faced in their own organizations, the number of respondents from different sectors and with differing viewpoints overall who mentioned this as a concern, pinpoints it as an issue the Agency should endeavour to address with its stakeholders in a proactive way.

Agency decisions profoundly affect the Canadian economy, and many of the players who watch the decisions closely have a long institutional memory of their own, with enough background and understanding of the issues to predict what the Agency is going to rule on certain matters. This, of course, facilitates stability because stakeholders understand implicitly the ramifications of their actions and design their business plans to comply with their predictions of Agency decisions. When decisions surprise them, or fall outside the scope they have determined is reasonable for their business planning purposes, it can profoundly affect their business. Predictability is important, and whether staff turnover is negatively affecting predictability or not, steps should be taken to ensure that Agency stakeholders are confident that new staff have the knowledge and skills to effectively fulfill their Agency roles, as well as the understanding of the enormity of the consequences that some Agency decisions can have for Canada's transportation industry.

"This agency is new and it has lost a lot of its institutional memory because of turnover. And they want to matter and improve things and do better and while we respect that, they probably fell a little bit short. The fact there is a consistency and flow to previous methods and decisions and many of our business decisions are in part guided by the history of decisions made. While they are not bound by precedent, it is a good lead indicator, and this group has made more than one decision that has thrown that into question. And that hasn't been to the detriment of shippers, but that increases the potential for uncertainty of the outcome and then shippers are more reluctant to use their services."

"Mostly they are professional but because of their staff turnover a significant number of new people without experience in the transportation world have come in. Getting them up to speed has been a challenge and we have helped by giving briefings and background on rail. But that is an ongoing issue and it is on both sides. Some of our more experienced people are retiring, too."

"There are a whole bunch of resources out there of people who have been doing this for a long time and there is a learning curve for Agency staff. We want to help them make the right decisions and have all the background information so when they make a decision it is with the full understanding of what they are writing and the consequences of what they are writing."

"There has been a huge turnover in staff and they will literally admit they are new on the job but they are making decisions that make a huge impact on shippers across the country and they are making the decision without a full understanding of the issues."

"We think it is partly because they have new staff there including legal counsel and they didn't understand the decisions they made would have wide ramification even with the narrow focus of the decision."

Respondents suggest that the Agency undertake a more rigorous training initiative to ensure new Agency staff and members are seen to have a clearer understanding of both the industry they are regulating, and the ramifications their work can have on the transportation industry, and the Canadian economy as whole. Several suggested that site visits, whereby new staff and members can interact with industry, shippers, and other stakeholders in their own environment, instead of in Agency offices or Ottawa board rooms, could more quickly inform new Agency personnel about their organizations.

"Some concerns...a lot of turnover at the Agency in terms of members and staff. You have people with little experience having to deal with multi-million dollar complaints and they ask for pleading and they might ask questions and they then make decisions. I am not saying they are not intelligent, but if I feel they are sitting in their tower getting all this in writing and there has to be more hands on and more field knowledge. They used to have that and when there is a turnover you lose corporate memory. Going to the site and looking at the places, that would help to make better informed decisions."

"One other comment I will make is that there has been a big change in the legal staff at the agency and some of the knowledge and corporate knowledge within the legal department had disappeared and that's been a concern. Certainly if there are new young lawyers coming in they need training."

There is an acknowledgement that some of the turnover problems being experienced at the Agency are, in part, driven by industry ‘cherry-picking' their best people for their own staffs. Respondents did call for the Agency to ensure it has succession planning on its radar, perhaps to ensure a large scale change in personnel does not happen again.

"Other than...making sure they are sufficiently resourced in terms of staffing and having overlap in terms of succession planning. Because if you have people and knowledge going out the door, like in net salvage, there is pretty specific expertise and [company] and [company] have been cherry picking their staff. We have failed in our own succession planning and we are all kind of poaching from each other."

"The broad question with regards to transitional issues in terms of labour or manpower - and we can't take our eye off that ball – is staff turnover in the industry and for them, too. And we have to keep that front and centre and it is a process that has to be managed on an ongoing basis."

One other point on staff that received mention several times was the ‘separation' of "staff" and the "Agency". It is considered unusual by some for staff to participate in the drafting of decisions, especially when the same staff members interact with complainants or carriers when they are preparing their case. The Agency is seen on other occasions to ‘hide behind' that separation, rendering decisions on processes when staff assured stakeholders they would not.

"There is no transparency. There is no guarantee what the exchanges are between the staff and the decision makers. From my understanding staff participates in the drafting of the decision and that is rather unusual. They need to work a bit more on their due process. There should be a split between the members and the staff – maybe similar to the way the Human Rights Tribunal and Commission are split."

"The Agency is the Agency – members or staff or who? And the Agency plays on that. At the 11th hour [the staff] find an issue and there is not time to deal with it and how can you identify new things at that point? It should be stable. Then staff writes back and says we'll deal with it next year. The decision then comes out and there is a decision on it. [We say] ‘staff said we wouldn't do it', but they say ‘we aren't staff, we are the Agency'. And now I have to ask who is speaking? That's a lack of transparency and fairness."

Dispute Resolution

Overall, respondents are enthusiastically embracing alternate dispute resolution processes. Not only do they save time and money, they are also seen to facilitate better outcomes for both the complainant and the transportation operator. Face-to-face discussions, which allow for a back and forth verbal exchange, are seen to facilitate a better understanding of the issue at stake for those on both sides.

Facilitation

The first step in dispute resolution, facilitation, offers an "informal exchange between you and the transportation operator" and for which the "Agency's role in this informal discussion is to offer its expertise and help define the issues involved."Note 1 Facilitation is very well-regarded by transportation operators and other stakeholders, and is felt to often result in quick and easy resolutions that are virtually cost-free for all the parties involved. The Agency is seen as doing an effective job of facilitating this dispute resolution process, but is also encouraged to increase its assistance and facilitate this type of dispute resolution more often.

"Well, I think certainly the informal discussions that individual companies have when we put them in touch with people [at the Agency], they have been quite satisfied with the informal discussions with staff and may decide not to go to a complaint or to seek mediation after their discussions, so those work well."

"There was a complaint and I asked to go to mediation and other side said no. I said ‘let's meet, you and I', and they said ‘no, I only want to go through litigation'. Then I said ‘let's meet' and that led to a second meeting and then...we felt a fourth final meeting would resolve it and they did come and we resolved the matter at the fourth meeting. Why? Because we met to try to understand each other…and if we could do that on our own we could do it that much better with the assistance of the Agency."

Mediation

Canadian transportation providers are almost unequivocal in their praise for mediation. It is seen as being cost-effective, transparent, and efficient. The Agency receives praise for the amount of resources they have allocated to this process: it is seen to be successful in part because of the Agency's commitment to it. It is recognized not only as a process that can work for simple disputes, but also one that can be used to effectively mediate complex issues. The allowance for face-to-face interaction and discussion can result in a faster negotiation process between complainant and providers; the inaccuracies and misrepresentations that can arise though paper-only exchanges can be readily amended in a face-to-face interaction where questions can be asked – and answered – on the spot. As noted by one respondent, "people start talking, and it changes the tone of things." Agency staff were praised both for their facilitation role, and for the expertise they brought "to the table" in mediation processes.

"We ended up at meeting and it was face-to-face and the complainant realized there was a human side to [company name]....we left as friends and it was amazing. The Agency process helped us, bringing us face-to-face and trying to build relationships and find common ground."

"I really appreciate the mediation and dispute resolution. And I think it saves us both work in the sense that we can save an adjudication for the Agency and it is a better use of resources and it has been successful. And I really appreciate the resources they have put into it; it hasn't been an afterthought and they really have given us their top people."

"... they felt the mediation process was transparent, practical, efficient and cost effective."

"Their mediation services have been excellent. The issues that are in dispute between the railway and members of the community are often difficult to resolve so the mediation services allows parties to get together in a fashion that isn't litigation, and has no timelines, to see if they can craft a solution. So tough issues that don't have easy solutions, it gives a last opportunity for people to vent issues and come to some solution short of a solution being imposed."

Concerns about mediation were centered on three specific issues. There was concern about the imposition of compulsory mediation, which presently contradicts Agency policy:

"If you want to try to resolve your dispute through mediation, let the Agency know. It will contact the other party to see if it is willing to participate."

However, several respondents – both shippers and carriers – did note that they did not endorse compulsory mediation. Some respondents also felt that individuals, especially in the cases of consumer complaints or accessibility or accommodation complaints from people living with disabilities, could be intimidated by the process, and could, as well, be intimidated into choosing mediation as a dispute resolution process. Thirdly, though the general satisfaction with the process overall indicates most mediators are performing well, there were some concerns raised about the quality and impartiality of the appointed mediators.

"It seems to me mediation works best where parties agree voluntarily to mediate so that would be best, and forced mediations would be second best, and if one party wants to go right to arbitration that should not be discouraged. I think it should be up to the people who are in conflict."

"Mediation is something that the agency cannot require, [they] cannot impose it."

"Mediation is great as long as it is not forced because it will be used as a stall tactic by the carriers. The railways would like to argue that before final offer arbitration we should have a way to mediate and we say we've been negotiating for five months and the leverage we have is Final Offer Arbitration and the only reason you want to mediate is to get more information."

"Often our mediation cases are accessibility cases, by complainants [that] are disabled, and we automatically have to do the hearing where they are located. It is a pain for me to travel for example to Sydney in the winter. We have to travel there, in and out in the same day. It's quite an ordeal – quite an imposition on us." Major Carrier (Air)

"The use of mediation, while that may resolve an individual complaint, part of the difficulty is often people are not aware of what the result is and it is not necessarily equitable because the individual files a complaint against a large corporation. And the individual felt she had to resolve it in that format and she felt intimidated.'

"Some have more talent to mediate than others…I am generally very satisfied."

"I am not impressed by the quality of their mediators in assisting the parties in coming to a settlement. The mediators don't take a hands-on approach. They simply report back what they said or organize the meeting. We most often settle directly. They don't actually mediate. They were trying to push us to deal with a mediator who [notes conflict of interest]. We had to insist that we would not deal with him."

Final Offer Arbitration (FOA)

Though the FOA process is considered by many to be a rail-specific dispute resolution service, it can in certain circumstances be utilized to resolve issues pertaining to the movement of goods by water or by air as well, and thus is included in this section of the report. Only shippers who use rail, and the rail sector industry and associations commented upon the procedure during the course of the research. Though considered to be time-consuming and expensive, the FOA process is generally considered to be fair, and to produce results; the inevitability of an arbitration ruling is seen to force movement on both sides of the issue. There were concerns raised about the Agency's role in the process; though it was seen as reasonable for the Agency to provide assistance to complainants, they should not be seen to be providing evidence. As with the mediation process, there were also some concerns raised about the quality of the arbitrator pool.

"Final offer arbitration, as far as I know, the shippers are generally satisfied with FOA. The biggest complaint is that it is expensive to mount a final a FOA, but I think it tends to work and shippers are generally satisfied with the result. Often it just brings the railway to the bargaining table and that gets an agreement, and that is good between the buyer and the seller."

"The FOA forces you to get closer together on the offers because he has to pick one or the other so it forces movement."

"This is a process before the arbitrator, and that's someone outside as mentioned, and some parties who go to an arbitration are always try to bring the Agency in. And the Agency should be trying to get out of that process and they should only appoint the arbitrators and manage the exchange of information and they should never get inserted in the process unless both parties ask for it. The other side always asks them to do a costing and they shouldn't because then they are providing evidence. And they can provide assistance but not evidence."

"The role of the Agency in Final Offer Arbitration is very limited....[one thing is] to have a roster of arbitrators to conduct the arbitration and the parties have to choose from that roster. They have done a very bad job of that. They asked who would want to be on the roster and they took them all without vetting. You can't just be an arbitrator, you have to have knowledge. There is a lawyer who represents shippers in FOA's on the roster. It's the epitome of conflict. [The Agency should be] much more involved in getting competent and experienced people on the roster."

One respondent also surmised that another level of arbitration could be added, a fast tracked arbitration process for day-to-day problems:

"Well, level of service complaints are good for systemic and egregious issues. But there is another level that could be added. A fast-tracked arbitration process that would take place quickly for day to day problems. There are lots of examples around that would take 14 days or one month and then an arbitrator rules. That would be helpful."

Formal Agency Decisions

For the transportation provider, most of whom have legal staff in house, a formal decision made by a panel of Agency Members is a process that - though long, rigorous and expensive - is relatively well-received. Because it is quasi-judicial in nature, it is understood that the process has to satisfy the law: "Its decision is binding, and can carry the force of a judgment from the Federal Court of Canada or a superior court of any province."Note 2 Therefore, transportation carriers are comfortable with the timelines allotted and feel there is little that could be done to streamline it. There was some concern that there could be more consistency in the rules of procedure ruling formal Agency decisions, and a call to better define issues to be ruled on at the beginning of a suit. Better defining issues could also mitigate the amount of data that must be shared and examined in the course of the suit, another benefit to narrowing the issues.

"We are going to a formal oral hearing and that is where you want all of this evidence presented and in terms of the resolution of the complaint they are quasi judicial I don't know how much you cut out. You could shorten the timeline but because it is quasi judicial you have to have it satisfy the law."

"Generally in complaints [it's] 120 days resolution, and they seek extensions which we are happy to provide which is ok. You can get a fast decision or a good decision so it makes sense to extend."

"I tend to think that procedurally they are not as rigorous as they might be, and they have rules of procedure published, but a complaint never seems to follow those paths so from a predictability viewpoint there seems to be rule changes that make it difficult. We would be better served if the rules of procedure – it doesn't matter what the timelines are just as long as they have everyone the same – if the rules of procedure were consistent."

"Defining issues at beginning of suit – when a shipper puts in complaint they are not often legally represented so the complaint can be a bit rambling. They are unhappy and they have committed to paper why, and then the railway looks at it and says well really, there are only a few issues amongst all these complaints. And the agency could step in and say I hear both sides and these are the specific issues we are going to determine...halfway through you can't change what is in dispute and it does happen with the CTA procedures."

"That worked fairly efficiently, we have a lawyer on staff but I would think that it might have been expensive for the complainant. We went together with the [sister association] and it was fairly expensive for them because they had out-of-house legal and we have in-house, but I think they [the CTA] are fairly efficient and it wasn't too expensive to deal with."

For some shippers, the formal Agency decisions can be seen to offer rail carriers an opportunity to stall proceedings and make the procedure as difficult as is possible for their opponents. For not-for-profit organizations with limited resources, the length of time a proceeding takes can neutralize their ability to mount a complaint simply because they run out of resources.

"The process is too long and too expensive. And I know that's a frustration for the agency and it's frustration for them and for us but it is a tactic of the railway to make it as inconvenient as possible. I don't know that the CTA is looking for solutions and I am not sure they are in a position because of procedural and protocol matters beyond their control. If you could tweak the Act that would work but I don't think a quasi judicial tribunal could lobby for increased power."

"The railways are great at dotting all "I's" and crossing all "T's" and every right they have is known to them and it defeats the purpose of the formal Agency decisions."

"The process was probably a lot slower than we had hoped. […]. Understandably the process gets much longer when the carriers take a combative role and they fought this and we had many hearings and they sought to appeal the final decision […]. The process was against a well-resourced opponent who took every opportunity to stall. This is a challenge for the Agency. As a not-for-profit organization is not well resourced, and we could have failed [in the complaint] spending money on legal costs we didn't have."

Impartiality

CTA is a quasi-judicial body tasked with, among its other roles, rendering decisions on disputes between the transportation carriers and their users. It will perhaps come as no surprise that a number of respondents question the CTA's impartiality; indeed, it may be an impossibility for the CTA to ever achieve a reputation for complete impartiality. It cannot however operate effectively, with full cooperation from its stakeholders, if is not seen to be striving to achieve impartiality.

"[CTA's] only value is [its] perceived fairness.

"[As] a good economic regulator they should be unbiased and should be seen to be unbiased. And even if it is just a perception of bias it should be dealing with the perception. If they could analyse and quantify [that perception of bias] it - and maybe it's wrong - but whether it is an actual problem or just a perception of a problem it should be dealt with."

"Anytime there is a decision against us, you wonder. But what is fair? In those two decisions they weren't unfair and I think they looked at all the evidence."

Interestingly, there were stakeholders from both sides of various issues – shippers and carriers, consumers and airlines – who felt the Agency was slanted toward their opponents. Some respondents even admitted their own bias in considering the Agency's impartiality. When considering the totality of the responses on the question of Agency impartiality it is likely that the Agency is, at present, maintaining a relatively good balance in the eyes of its stakeholders. However, it must be ever-vigilant on this front. Without the perception of impartiality, the Agency cannot fulfill its mandate. Key to the Agency's perceived impartiality is its performance. Stakeholders feel that it must be seen to act as a court, to rule on evidence, to carry out due diligence, and to allow all parties to air their views in order to ensure that its stakeholders have confidence in the process.

"The general feeling is that the Agency views themselves as the public defender instead of as an impartial body. "

"Not sure that I necessarily agree with this but a lot of people in shipper community tend to feel the agency's bias is toward the railway from some segments of the shipper community."

"I would like to see them strike a better balance between consumers and carriers. They are a judicial body and they need to be looking at things fairly, it's critical they are fair and most [carriers] don't feel that way. If it is fair, why are the decisions always for the consumer? [But] I am biased."

"I recall my colleagues would think some recent decisions are not fair and some recent decisions are fair: it is in the eye of the beholder. Was the process professional and done properly and with due diligence and a thorough airing of the views? And did all parties have the opportunity to say and do what they wanted? Then the decision is the decision. If you have confidence in the process, that is fair. There will always be a winner and a loser"

Transparency

For many respondents, a key pillar in achieving the confidence of stakeholders in the impartiality of the Agency would be to increase transparency: if there is clearly no evidence of bias, then bias won't be considered. One suggestion made by several respondents would be to write more fulsome decisions that better explained how the decision was made. As noted by one respondent, the winner doesn't care how the decision was made, so, "…the Agency should always write decisions with the loser in mind."

"On a communications front we want better decision markers: more transparency, more upfront, and more detail. It doesn't mean you have to release details...you can talk about it in the aggregate but explain why you made the decision."

"The transparency… if we had a little more clarity we would feel they were being more fair and some of the challenges we have had with decisions we would tend to be less pessimistic that they are being anal or holding their cards or being pro-consumer. And then you jump to /conclusions that aren't accurate and they could be more forthcoming... and there are some individuals in the CTA who are better than others. I believe there should be a certain baseline of transparency."

A lack of transparency was also noted in circumstances where Agency staff request information or data without explaining what it will be used for. Stakeholders believe that they are not, in these cases, being given the opportunity to ensure all the data that might be relevant to whatever the Agency is working on is being presented.

"Sometimes, the staff says we want this data, and we say why, and they won't say. But if you don't provide it will be held against [you in the decision]. And we all know you can produce information to support any position. If they tell you we need it for ‘this' we could also say you should have had this other information as well. That should be much more open, and it used to be that way, and I don't know what causes this. A member or the chairman should be concerned because it undermines the credibility of the institution."

Accessibility and Accommodation

Accessibility and accommodation issues are a hot button for the airline industry at present, though the rail and marine passenger industries are also affected by CTA decisions on this front. The January 2008 Agency One-Person-One-Fare Policy, upheld by the Supreme Court of Canada, determined that Air Canada, Air Canada Jazz, and WestJet were not to charge more than one fare for persons with disabilities who are accompanied by an attendant for their personal care or safety in flight, as required by the carriers' domestic tariffs; or who require additional seating for themselves, including those determined to be functionally disabled by obesity. This decision represented the culmination of a long dispute fought bitterly by the airline industry. The February 25, 2010 ruling that three individuals are persons with disabilities in the context of air travel due to their allergy to cats also raised alarms in the industry. Many have expressed concern that the Agency is acting more as a consumer advocate than an impartial quasi-judicial body on the accessibility file, and is not considering the true financial hardship these decisions have on the industry when they are compounded over time.

"Members have felt...there is a trend toward consumer advocacy and CTA needs to be true to its principals. There can be that tendency to not be impartial. I think it is about understanding how airlines operate and the costs involved and it needs to be much more conscious of that, more research and analysis before any decisions are made particularly issues that are touchy."

"The definition of undue hardship is a difficult test to demonstrate that we can't accommodate beyond that point and the results of the decisions are that we have to accommodate and there is a bias toward the guest. You couldn't define it but...listen, it is hard to say you can't afford to provide a buffer zone for nut allergies but the concern is that over time all of these factors are going to make it difficult for us to operate. CTA has to acknowledge the long term impact of these decisions in total, not just on a case-by-case basis."

On the other side of the coin, advocates for people with disabilities decry airline and rail carriers' reluctance to embrace accommodation. In their view it is discriminatory, and is also short-sighted in that accommodation will be needed for more and more of the Canadian travelling public because of the aging population. They also point to a reluctance to accommodate in simple ways, such as providing captioning on entertainment systems, without undue pressure being applied.

"Just a comment that the cost of ensuring access if spread out over the fares that are charged is not a substantive increase in any fare…we always get the argument this is too expensive. But the decisions have said these do not create undue hardship and this is reasonable and an accommodation that must be provided. [It's the] cost of doing business. The public includes people with disabilities and the public that will need access is growing with an aging population…a demand for accessible transportation will continue to grow."

"Now they have captioned it [entertainment systems, for deaf passengers] but it took a number of years and they said they couldn't do open captioning because two languages were going to take up too much space….but they have now managed to do it."

In terms of the way forward, though voluntary access codes are in place, advocates for people with disabilities are unhappy with the level of voluntary compliance from carriers, and want to see regulations adopted, mirroring the regulated access standards in place in the United States, Great Britain and Australia. Regulations on accessibility and accommodation issues are also endorsed by some respondents on either side of the debate: for some carriers, regulations are seen as being the best solution, one that would negate the need for case-by-case resolutions that affect only the carriers implicated, thereby creating an even-playing field for everyone in the marketplace. Rail carriers are watching developments on this issue very closely, as passenger service continues to grow. These carriers want to have input, but they also want guidance and leadership from the CTA.

"Our priority is the establishment of accessibility regulations that would govern all modes of federal transportation. The agency needs to move forward with regulations so people with disabilities know what to expect, and carriers know what to provide. We spent many years developing voluntary codes of practice for all …those voluntary codes don't appear to be working. And just as they have done in the United States and Great Britain and Australia, we need access standards that are regulated that will ensure accessibility. The individual complaint by complaint [system] is time consuming and results in individual remedies and does not address the systemic issues. We are being surpassed by other countries."

"I also have issues with the Act that provides for regulatory powers. They aren't exercising these powers but responding to complaints and dealing with things on a one-off basis and making decisions that have an impact only on the carrier against which the complaint was made. There is no consistency in their decision-making processes. Now the Canadian Human Rights Tribunal is asserting jurisdiction over this. The CTA has not adopted a regulation since 1996. Adopt regulations that would allow....a level playing field for everybody."

"Disability and accessibility. With the rapid growth of passenger rail in major urban centers and in inter-city rail, it is very important in terms of making sure we have the right approach."

"The US has the DOT and Europe has economic authority enforcing but because the CTA is quasi-judicial there isn't just a list of regulations, it is always a negotiation. Whereas with the Department of Transport, for instance, they tell us what we must comply to. For a number of issues like the wheelchair or the allergy file, if they could bring it to us for input the Major Carrier is desperate for guidance. And it would be great if there was a standard or objective assessment and it is hard to get that from CTA. Sometimes we'd like a little more leadership. Yes, consultation, but at some point you have rules you have to follow. The problem with the complaint based thing is you never know how it is going to play out. And maybe that expensive assessment should be born by the government, the assessment needed for setting standards for carriers to follow, as it is in regards to security."

Accessibility Advisory Committee

The work done by the CTA's Accessibility Advisory Committee, and the opportunity for dialogue and input it provides industry and the disability community, is appreciated by its members. Members do note that it has not been held annually as planned, and meetings should adhere to its planned annual schedule. Members also noted that along with the annual meetings, conference calls on specific topics as they arise might benefit members and the CTA.

"The accessibility group (their sub-committee) has been particularly effective at dialoguing with the industry. As far I know there are a lot of consultative meetings that have been organized and we are invited and represented by sub-committee members who report back, and on the one person, one fare and the allergy issues there have been regular meetings and there has been a certain level of satisfaction with the dialogue."

"The Accessibility Advisory committee...probably the one thing that comes to mind is that it is supposed to be meeting annually and we hadn't met for three years until last March, and is the only vehicle for us to have input on transportation issues....this advisory committee is an important link with the disability community."

"The Committee ‘s mandate is to meet once a year and even if some meetings were on specific topics and we met by conference call more often that might be positive and helpful."

Railway Industry

The railway industry in Canada is unique in that the number of carriers is very small, with many rail lines being operated by only one carrier. This negates the normal market forces that govern supply and demand in any given industry, and makes CTA's role all the more critical. Shippers and carriers alike understand the ramifications of this captive market, and though carriers would like to see market forces more at play in determining pricing, they do acknowledge some intervention is necessary. Shippers would like to see even more oversight, which they believe would result in fewer disputes overall. Although both shippers and rail carriers do have some concerns with particular Agency processes and policies, for the most part both groups view the Agency as being a positive force that regulates their industry relatively well. Industry insiders want the Agency to be forward looking as growth is predicted for the rail industry over the foreseeable future; the CTA must ensure its economic oversight is on pace with industry realities.

"They…know they are the only the guy in town and they charge rates and provide service according to having that monopoly. So the decisions the agency makes can have a huge impact on our industry."

"In general it has been very positive over the past few years because they now have a legislative framework that is helpful, and we as an industry want this relationship to work. The industry freely admits there are shippers that are captured and others because of their size may fall between the cracks so this is positive. As long as it's predicated on good policy let's have good and efficient ways to intervene if it's necessary and that's their role and they do a reasonably good job."

"I think they are too remote from market and commercial decision making. A regulator should look at markets and the markets are what they are. Some are competitive, others less so, and they are a bit interventionist. They shouldn't be a substitute for a market forces they should only be there when market forces don't work."

"Well, obviously what they do is make rulings, on rail disputes and they [the disputes] are far too frequent. We do see a role for them in terms of ongoing vigilance – in terms of them we are looking for them to pay a greater oversight role where railway disputes come up."

"As rail grows, and no doubt it will on the passenger and freight stage, all these issues such as proximity and logistics are going to become more complex. And while the policy framework is generally right there are challenges that will be put on the table and apart from transactional stuff we have to stay close to trends and I predict a bigger problem. The policy framework has to evolve and the Agency has to be thinking ahead. Given CTA's role in being the economic regulator [the Agency] is an important part of that."

Research findings specific to the rail industry are presented here by category. As to what key challenges industry executives felt were most relevant to their industry at present, opinions differed. Common themes, though, included concern about the consistency of Agency rulings, which affect stability and therefore the ability to procure capital investment necessary for growth, the Cost of Capital publication/methodology review, and the importance of the first decision on noise.

"For me the noise issues are the most important, and these first decisions coming out are going to be really important in managing expectations: they'll either narrow the complaints or open up the floodgates and they need to make sure they are balanced and they have to look to make sure they know what impact they will have….it could affect shippers and affect the whole economy."

"Well, we are coming out of recession and I think in the next 12 months we will be focussed on return to growth."

"More germane to the agency is the whole regulatory environment and the stability thereof and it had been reasonably positive. Maintaining that stability is very important because investors into the industry need to see that regulatory stability and we need large capital investment to meet demand in the growth scenario so their role is particularly important in a growth scenario."

Cost of Capital Methodology Review

The Cost of Capital Methodology Review is making rail carriers happy, and shippers nervous. From the rail carrier perspective, the "murky" publication/methodology utilized in the past made predictions difficult; carriers need to be able to predict the Cost of Capital somewhat accurately in order to produce viable business plans. Rail carriers acknowledge that that the cost of capital should not unreasonably burden shippers, but do want to ensure a fair return to carriers. For most respondents representing rail companies, the cost to the shipper should be irrelevant to the publication/methodology, and not manipulated to reflect a pre-determined shipper cost ceiling.

"They are looking at the whole publication/methodology this year and when they sent their first document they said we need to ensure its right because rail companies are entitled to adequate return, but also not so high as to increase the cost to shippers. The cost to shipper has nothing to do with the cost to capital…"

"With the cost of capital, for instance, right now the Agency can determine it using three different methods, and what it does is it hears all of the evidence and goes into a virtual black box and decides…and next year that could be different and as a railway we don't know what that – which method of calculation - is going to be. It isn't set up in the statute that you regulate rates but it is thought of in that fashion. Where we would come from, we want the cost of capital to be whatever it actually is – calculated but not manipulated. We want the Agency to have a transparent way of calculating it; not deciding which of the three methods they'll apply at the time."

Shippers are concerned that their costs will increase, and do not believe that a Cost of Capital publication/methodology review is warranted. Many also believe the review was initiated based on pressure from rail carriers, and that they should have been informed about the review prior to the release of the draft terms of reference came out so that they could provide feedback.

"They actually at first mentioned it was at the behest of the railways but they don't say that as loudly anymore. They know there should have been more consultation [prior to the review of the cost of capital] prior to the process and they agree. The only reason we are fighting it is to ensure they do more consultation the next time."

"Capital cost is certainly a concern, that opening up capital cost accounting provisions will be a problem for shippers and a lot feel it is not appropriate that it be opened up at this time. But it remains to be seen how that plays out and what issues are raised."

"One of the problems was we had, we had no idea that the agency was contemplating doing a review until the draft terms of reference came out …you are obviously trying to influence them but we understand the job they have to do but we want to impart our knowledge about how things work and what the railways do and how they behave so they have a full understanding of the dynamic between a shipper and a handler before they make their decision. But I think they have to be able to ask the right questions and the difficulty was that we didn't even know they were dealing with the issue before the decision was made."

Grain Revenue Cap

The Grain Revenue Cap is a source of irritation to rail carriers who, perhaps unsurprisingly, think it is artificially low. Carriers point to a pattern of Agency decisions against them on revenue cap issues as being proof of an Agency "bias" on this front. The one time changes to the Volume Related Composite Price Index in February 2008, reflecting the actual costs incurred by rail carriers for the maintenance of grain hopper cars and reducing the historical maintenance costs that were "embedded" in the revenue caps, resulted in significant fines for carriers for exceeding their revenue caps. This was perceived as further proof for carriers of the Agency's ‘shipper advocacy'. Some carriers feel this is short-sighted: if grain transportation is not as profitable as other revenue generators, will carriers continue to reinvest in it? And for one shipper association not involved in the grain industry, precedents set for grain do affect their industry as well: this respondent suggests the Agency should consider every industry when it makes decisions about grain transportation.

"I've done a review of revcap decisions and if someone was to look at them you'd wonder if the railways can be wrong on it all the time…That is the one area where there is a bias. I don't think they understand the impact… grain is the least profitable of all the products the RR is moving and in a store you don't invest in the product making you the least money. It is short sighted because you don't reinvest in your worst product so they are putting that at risk. They are well meaning but I don't think they see the big picture."

"I think they have tended more as of late, though they have always had a shipper bias, and it seems more pronounced lately than in the past three or four years. I get signals they see their role is to be an advocate for the shipper or to protect the shipper. The last really clear signal would have been when they adjusted the VRCPI to reflect maintenance costs and in the descriptions in the correspondence [stated] that they had a mandate to control rates."

"They probably think they do a good job and our industry doesn't have a problem with the decisions on behalf of our companies, but a grain related decision has been handed down that is going to affect everybody. They say it is only grain related and our lawyers will tell them the railways will say that the same decision should be taken for other industries. They create unintended hurdles for us."

Proximity Issues

Rail carriers are concerned – some identify noise and proximity issues as being their key challenge at this time – about the noise and proximity complaints that have emanated from the June 2007 amendments to the Canadian Transportation Act. These authorize the Agency to resolve complaints about noise and vibration caused by the construction and operation of railways. (One airline executive also expressed concern about the upcoming noise decision.) The number of mediations has become a burden for the rail industry, and they are concerned that should the upcoming noise decision not be in their favour, it will open the floodgates for complaints against them, even from complainants who bought or built property beside existing lines or yards. The December 7, 2009 GO decision is seen as being precedent setting, and rail carriers are concerned that other decisions on hours of operation could damage their operational capacity, affecting not only themselves, but shippers, and the economy as a whole.