Decision No. 149-R-2012

DETERMINATION by the Canadian Transportation Agency of the 2012-2013 volume-related composite price index required for Western Grain Revenue Caps pursuant to Part III, Division VI of the Canada Transportation Act, S.C., 1996, c. 10, as amended.

INTRODUCTION

[1] The Canadian Transportation Agency (Agency) is required to determine by April 30, 2012 the Volume-Related Composite Price Index (VRCPI) for crop year 2012-2013 commencing August 1, 2012 and ending July 31, 2013.

[2] In this Decision, references to 2012-2013 mean the crop year from August 1, 2012 to July 31, 2013. All other two-year periods in this Decision refer to crop years from August 1 to July 31.

BACKGROUND

[3] The "revenue cap" program, established August 1, 2000 for the movement of western grain by prescribed railway companies, requires the Agency to annually determine a revenue cap for each railway company and to subsequently determine whether each railway company has exceeded its cap.

[4] Subsection 151(1) of the Canada Transportation Act (CTA) provides the formula that the Agency is to use in determining the revenue caps. One of the inputs to the formula is the VRCPI.

[5] Subsection 151(4) of the CTA states that:

The following rules are applicable to the volume-related composite price index:

- in the crop year 2000-2001, the index is deemed to be 1.0;

- the index applies in respect of all of the prescribed railway companies; and

- the Agency shall make adjustments to the index to reflect the costs incurred by the prescribed railway companies for the purpose of obtaining cars as a result of the sale, lease or other disposal or withdrawal from service of government hopper cars and the costs incurred by the prescribed railway companies for the maintenance of cars that have been so obtained.

[6] The development of the 2012-2013 VRCPI involved detailed submissions of historical price information of railway inputs (labour, fuel, material and capital) from the prescribed railway companies, currently the Canadian National Railway Company (CN) and the Canadian Pacific Railway Company (CP). The submitted information was reviewed and verified by Agency staff. In addition, Agency staff developed forecasts for future changes in the price of railway inputs.

[7] There are unique aspects to the 2012-2013 VRCPI determination in that it reflects the impacts of new methodologies introduced in two significant Agency decisions:

- Decision No. 425-R-2011 ─ Review of the methodology used by the Canadian Transportation Agency to determine the cost of capital for federally-regulated railway companies, issued December 9, 2011 (the Cost of Capital Decision);

- Decision No. 97-R-2012 ─ In the matter of pension costs and the averaging methodology in the development of the labour price index, issued March 22, 2012 (the Pension Decision).

[8] This is the first VRCPI determination decision following the adoption of these new methodologies. The cumulative effects of the Cost of Capital Decision and the Pension Decision, along with other price changes, result in a significantly larger change in the VRCPI than in previous years. The Agency, therefore, considers it important to point out relevant aspects of those Decisions, the context in which they were made, and how those Decisions have contributed to the VRCPI determination for the upcoming crop year.

Cost of Capital Decision

[9] The Agency considers it good practice for a regulatory body to periodically review the methodologies it uses to ensure that the Agency keeps current in fufilling its regulatory mandate.

[10] To that end, in 2009, the Agency initiated a review of its methodology for determining the cost of capital for federally-regulated railway companies, as it had been five years since the Agency’s last review of this methodology. This review was initiated on August 14, 2009 and concluded on December 9, 2011 with Decision No. 425-R-2011.

[11] The Cost of Capital Decision was the culmination of an extensive review that included research and consultation phases. In the research phase, an expert consultant was hired to provide the Agency with an evaluation of existing techniques for determining the cost of capital. In the consultation phase, interested parties were invited to provide their submissions and expert opinions on the issues. The Agency undertook a careful and thorough examination of all the information provided and the issues raised and evaluated them based on clearly defined criteria.

[12] In essence, the Agency concluded the following in the Cost of Capital Decision:

- Cost of capital rate determinations will be based on the book value of the assets;

- The Capital Asset Pricing Model (CAPM) will be used for determining the cost of equity rate;

- The cost of debt rate will be based on the embedded costs of debt;

- The assessment of a risk factor for the movement of regulated grain in western Canada is no longer necessary;

- The cost of equity rate will reflect the market conditions in both the Canadian and U.S. equity markets; and,

- Technical parameters used in the CAPM will conform to the requirements set out in the Decision, including an averaging period for the market risk premium (MRP) that will be based on the longest reliable time series that is available.

[13] The Cost of Capital Decision largely re-confirmed existing Agency practices, with two notable exceptions. First, the Agency now recognizes that the cost of equity rate must reflect the North American, rather than solely Canadian, market conditions. Second, the Agency now uses a MRP based on the longest possible time period for which reliable information exists for establishing the MRP, 1951 in the case of Canada and 1954 in the case of the U.S.

[14] With respect to the recognition that the equity rate for railway companies shall reflect the North American market, the Agency concluded the following:

[286] The Agency acknowledges that North American financial markets are increasingly integrated and that the railway companies raise capital on an enterprise-wide basis in both the Canadian and U.S. markets, with no distinction being made in the raising of that capital that it will be used exclusively in one market or the other. Further, the Agency recognizes that in this environment CN and CP have to respond to the return expectations of investors in both markets. Therefore, the Agency finds that the concept of incorporating the use of both Canadian and U.S. market data into the CAPM calculation is justified and reasonable, and allows for a better assessment of comparable risk.

[287] The Agency will implement this concept in a transparent way that can be applied consistently and meets the Agency's three criteria. Accordingly, the Agency will determine a separate cost of equity for the Canadian and the U.S. markets, and combine the two using a weighted average based on the relative proportions of the volume of each company's shares traded on the TSE and NYSE, in the full calendar year preceding the forthcoming crop year, for each of CN and CP.

[15] Regarding the decision to adopt the longest possible time period for which reliable information exists for establishing the MRP, the Agency concluded as follows:

[335] Given the absence of any conclusive evidence of a structural break in the market premium time series and in order to satisfy its three criteria, the Agency will use as much historical return data as possible, subject to the availability of reliable data. Accordingly, the Agency determines that it will adopt the use of an averaging period that comprises return data from 1951 to the current year in the calculation of the MRP in the Canadian CAPM, and from 1954 to the current year for the MRP calculated with respect to the U.S. CAPM.

[16] The Agency also directed that the new methodology would be effective with the cost of capital determination for 2012-2013, and that this methodology will be applied by the Agency until at least 2018, barring extraordinary circumstances.

[17] Consistent with the Cost of Capital Decision, the Agency, in Decision Nos. LET-R-70-2012 and LET-R-72-2012, determined that the cost of capital rates for CN and CP for 2012-2013 would be 6.45 percent and 7.31 percent, respectively. The Agency notes that the cost of capital rates for CN and CP for 2011-2012 were 5.58 percent and 6.16 percent, respectively.

Pension Decision – treatment of pension costs

[18] In January 2010, during the development of the 2010-2011 VRCPI, CP stated that it would submit cash amounts it contributes to fund its pension plans, rather than the accrued expenses previously reported under Generally Accepted Accounting Principles (GAAP). CP stated that this change would be consistent with the requirements of the Agency’s regulatory mandate and the proper interpretation of the Uniform Classification of Accounts (UCA).

[19] CN also raised concerns about the methodology used by the Agency to average certain subcomponents of labour price indices.

[20] The Agency postponed a decision on these issues pending an industry consultation in 2010 with western grain participants. This consultation focussed on the appropriate method to account for pension costs for regulatory purposes and on the appropriate methodology for incorporating averaging into the development of the Labour Price Index (LPI).

[21] Given the time constraints and the complexity of these matters, the Agency was only in position to release its decision on these questions on March 22, 2012. In the Pension Decision, the Agency determined that:

[3] The pension costs recognized by the Agency for regulatory purposes for the Canadian National Railway Company (CN) and the Canadian Pacific Railway Company (CP) (railway companies) will comprise, for each year, current funding payments made into their respective pension plans, an amortized portion of statutory pension plan deficit payments, and direct railway company pension fund administrative expenses as follows:

i. cash payments in respect of contributions to pension plans and employee pension accounts (paid during the reference year or payable at the end of the reference year, both in respect of the reference year,) for Defined Contribution Plans, Supplemental Benefit Plans, Non-Registered Pension Plans, Post-Retirement Benefit Plans, and the current service portion of Defined Benefit Plans;

ii. cash payments in respect of contributions to pension plans (paid during the reference year in respect of the reference year or payable at the end of the reference year, both in respect of the reference year) to meet a statutory plan deficiency in Defined Benefit Plans, which will be amortized over the employee average remaining service life; and,

iii. direct administrative expenses (paid during the reference year or payable at the end of the reference year, both in respect of the reference year) incurred by the railway company (not the pension fund) in connection with the company pension plans.

[5] The multi-year averaging methodology for development of the LPI will be discontinued and be replaced by the standard price indexation methodology, i.e., use of single year input prices and quantities indices.

[162] The railway companies are directed to implement, with the approval of the Agency, two new accounts in the UCA to reflect the decision to amortize the statutory deficit payments. One account will reflect the unamortized statutory deficit payments, and the other account will reflect accumulated amortization of the deficit payments. Amortized amounts will be reflected in the existing pension account, UCA 821.

[22] To determine the method for recognizing pension costs for regulatory purposes, the Agency considered three different approaches: (1) recognize expenses based on GAAP accrual accounting; (2) recognize a full funding payment in the reference year; and, (3) match real resources to the periods of work by amortizing over Employee Average Remaining Service Life (EARSL). Each of these methods was tested against three criteria, namely that the method should: (1) recognize real economic resources, (2) be reasonably matched to the time period over which the work was performed; and, (3) be fair and reasonable.

[23] Based on this examination, the Agency concluded that the option of matching real resources to the periods of work by amortizing over EARSL was the only one which met all three criteria. The Agency noted that under this method:

[120] .....because the payments would be amortized over a time period that the Agency has determined to be fair and reasonable (EARSL), using the cost of capital for railway companies also set by the Agency in a manner that is fair and reasonable, it would result in a return in each year that is fair and reasonable.

[24] Furthermore, in making its Decision, the Agency decided not to continue applying the existing GAAP rules for recognizing pension costs for regulatory purposes, the Agency noted the following:

[110] .... GAAP rules by which expenses are accrued do not contain any mechanism for ensuring that, over an economically relevant period of time, the total amount expensed for pensions equals the total economic resources expended by a railway company on pensions. GAAP assumes that, in the long run, expenses recognized under GAAP will eventually catch up to the resources consumed. The railway companies may not be able to recover their pension costs in an economically reasonable period, and purchasers of their services in any given period may not be paying a price under the Revenue Cap program that properly reflects the economic cost of providing the services. Thus, GAAP expenses do not meet the criterion of being fair and reasonable to all parties.

[25] The Agency notes that both CN and CP are subject to the oversight of the Office of the Superintendent of Financial Institutions Canada (OSFI), and that CN and CP have made substantial contributions towards their statutory pension deficits over the last three years. For instance, CN and CP have reported in their publicly available reports to have made voluntary contributions amounting in the aggregate to $0.3 billion between 2003 and 2008. For more current comparison purposes, CN and CP combined have made voluntary contributions of approximately $2.9 billion from 2009 to 2012. Based on the Pension Decision, these payments, in addition to minimum OSFI required contributions, have been considered in this year’s determination of the VRCPI.

Pension Decision – price index averaging methodology

[26] The Agency also decided to discontinue the practice of using multi-year averages for certain components of the LPI and to adopt the standard price indexation methodology, i.e., single year input prices and quantities indices. This decision was based on the following rationale set out in the Pension Decision:

[145] First, multi-year averaging of inputs may be a technically incorrect methodology as compared to the recognized standard price indexing approach. A price index tracks changes in price over time by comparing the weighted price in one period with the weighted price in another period. If the weighted price in a given (base) period is kept constant, and weighted prices over time are compared to this constant, the price index is known as a Laspeyres index, a well-known and well-established price index. By definition, therefore, averaging prices over several years and using the multi-year averaged price as the price for a specific year may defeat the purpose of the price index and introduce unknown biases.

[146] Second, forecasting future price changes requires that historical price changes are accurately measured to understand the nature of the price movements. Multi-year averaging in the historical index can result in inaccurate measures of price changes and can produce a distorted view of historical price movements. Therefore, forecasts built on such distorted price movements are likely to be inaccurate and misleading. A forecast which is projected from already-smoothed historical events clearly would not reflect actual price changes.

[147] Third, multi-year averaging of prices may result in a built-in bias in the index. This is because, in order for such an average to be unbiased, prices must be just as likely to be high as to be low. As CN notes, a valid unbiased averaging methodology is such that the average is higher than some observations and lower than others, but is balanced over the averaging period. If, however, prices are rising over time, then a multi-year average will consistently be lower than the current price. Similarly, in a period of dropping prices the multi-year average will consistently be higher than the current price.

[148] Fourth, multi-year averaging of inputs is inconsistent with the treatment of other price indices developed by the Agency. As CN and CP both point out, the Agency does not average the even more volatile fuel prices over several years before using the averaged prices to develop the fuel price index, so there is no reason to average the labour prices. CN points out that if actual historical prices are volatile then the historical price index should reflect that reality.

[149] And fifth, multi-year averaging is inconsistent with the principle of matching in time labour prices and employee hours, which is central to the review of pension expenses.

[27] The decision to discontinue the multi-year averaging methodology as it applies to historical values affects four of the five components of the LPI, namely, wage-related benefits (bonuses, employee gain-sharing, etc.), fringe benefits (health and welfare, employment insurance, CPP/QPP, etc.), stock-based compensation, and pensions. The component for salaries and wages is not affected by the Pension Decision as it is already developed on a single year basis. In the previous Agency multi-year averaging methodology, an historical price index was developed for each component and the forecasting of the labour price index was based on a forward extension of the multi-year averages of the component indices, except for the noted treatment for salaries and wages.

[28] In the Pension Decision, the Agency also stated the following:

[144] The Agency considers it important to distinguish between two applications of the multi-year averaging, for forecasting of future price indices and for development of the historical price index. The Agency is of the opinion that multi-year averaging of historical indices is a legitimate methodology for arriving at a forecast of the index....

[165] ..... As a consequence of the Agency’s decision to discontinue the multi-year averaging methodology, a new forecasting approach will need to be developed for the labour price index.

[29] Consistent with the Pension Decision, the Agency has adopted single-year historical prices for all subcomponents of the LPI.

[30] Furthermore, after having considered the issue, the Agency continues to be of the view that multi-year averaging of historical indices for forecasting purposes is a legitimate method. It has therefore applied that approach to forecasting wage-related benefits, fringe benefits and stock-based compensation, and all pension components excluding pension amortization and pension asset amounts.

[31] However, multi-year averaging of historical indices for forecasting purposes is not appropriate for predicting the price associated with the pension amortization and pension asset amounts. The specific amounts of pension payments and pre-payments, subject to minimum payment requirements as determined by OSFI, reflect discretionary business decisions of railway company management. They are therefore highly volatile and difficult to predict with any accuracy. The Agency stated in the Pension Decision that it would recognize the voluntary pre-paymentsactually madetowards the pension fund deficit. However, the Agency is not prepared to forecast pre-payments towards a pension fund deficit based on railway company projections. The Agency considers such an exercise to be too speculative to produce reliable results. Furthermore, pre-payments that actually materialize will be recognized in the year they were made and validated by the Agency. For these reasons, the Agency will base its forecast on the minimum payments necessary, as determined by OSFI, for each railway company to address the pension fund deficit, net of actual pre-payments made as at the time of the Agency’s determination. The Agency will not recognize any projected pre-payments (i.e., projected amounts over the minimum OSFI requirements) by the railway companies.

[32] With respect to the current determination, CN has disclosed in its audited financial statement of 2011 a pension deficit of $1.4 billion. OSFI has recognized as a pre-payment for 2012 a contribution made by CN towards its pension fund deficit, although the last official actuarial report (2008) shows CN’s pension fund to be in surplus. This represents a special circumstance that the Agency has taken into account in accepting CN’s pre-payments.

Other price changes

[33] The preceding methodological changes affected only certain components of the LPI. Other changes to the LPI and other components of the VRCPI are briefly described below.

Labour

[34] The development of the labour price index captures price changes in wages, wage-related items (such as bonuses and stock-based compensation) and fringe benefits (such as government and railway company pensions, and employment insurance). In Decision No. 253‑R‑2006, the Agency determined that wage-related and fringe benefit price changes would be based on five‑year moving averages, with the exception of railway company pensions, which were to be based on ten-year moving averages, a methodology used up to last year in determining the VRCPI.

[35] For comparison purposes before adjustments related to the Cost of Capital Decision and the Pension Decision, the Agency has developed a 2012-2013 railway inflation component of the LPI using the same methodology as last year. Labour prices, applying the previous forecasting methodology, would have risen by 2.5 percent.

Fuel

[36] The railway fuel price index reflects changes in the average annual price per litre of diesel fuel. The Agency uses a long-established model based on the relationship of railway fuel prices and the price of crude oil. The model also accounts for any known hedging practices, federal fuel excise tax and provincial fuel sales taxes.

[37] The Agency relies on crude oil price forecasts from a number of expert third-party forecasters as inputs to the Agency’s fuel forecasting model.

[38] The average of the third-party forecasters for the price of crude oil used in the development of the 2012-2013 railway fuel price index is $US106.20/bbl for 2012 and $US106.40/bbl for 2013. An important element in the development of forecasts for the railway fuel price index is the Canada/US exchange rate. The average of third-party forecasts for the exchange rate in US cents per Canadian dollar is 99.6¢ for 2012 and 101.9¢ for 2013.

[39] The Agency fuel forecast model predicts a 4.1 percent increase in fuel prices for 2012-2013.

Material

[40] Railway companies purchase thousands of different material items each year, far too numerous to track individually. Therefore, the material price index reflects changes in the average annual price of a basket of railway materials, similar to the consumer price index. The Agency’s long-established methodology involves a series of regressions based on the major railway material components to forecast (based on third-party data) the average material price change. For crop year 2012-2013, the Agency is forecasting a 2.1 percent increase in the material price index.

Cost of capital

[41] As indicated above, the Agency has adopted a new approach for establishing the cost of capital rate for regulatory purposes. Again, for comparison purposes before adjustments related to the Cost of Capital Decision, the Agency has developed a 2012-2013 railway inflation component of the cost of capital applying the same methodology as last year. If the Agency had applied the previous methodology, the resulting cost of capital would have been reduced by 14.6 percent. This is largely a result of a lower cost of equity rate and a lower tax rate than in the previous year (assuming the CAPM model would have been selected and no grain adjustment factor would have been applied).

Other components

[42] Other components include leased hopper car rates, amortization of investments, and the net impact of replacing 1992 hopper car maintenance costs with more recent actual costs, as determined and implemented in Decision No. 67‑R‑2008 made by the Agency pursuant to Clause 57 of Bill C-11, passed in June 2007.

[43] Since last year’s determination, both CN and CP have applied to the Agency for an adjustment, under paragraph 151(4)(c) of the CTA, as a result of a decision by the Saskatchewan Government to no longer provide its hopper cars to the railway companies free of ownership costs. Consequently, both railway companies submitted requests for adjustments to this year’s VRCPI determination to take this issue into account. The Agency has yet to rule on these applications.

[44] The Agency has applied the same methodologies and cost basis as last year for each of these other components, including the Saskatchewan hopper cars. The combined impact of changes for other components is a price increase of 0.5 percent for 2012-2013.

Chaining of the labour price index and primary weights in the VRCPI

[45] The VRCPI is a weighted average of railway-specific input price indices. The total value was set at 1.0 when the Revenue Cap program was established (the base year 2000-2001). Fundamentally, the indices used in the VRCPI must express the current price levels relative to the prices in that base year. The baskets of goods and services and assigned weights have, in the past, been adjusted to ensure comparability of prices to the original base year.

[46] Methodological changes affect both the weights and the prices and therefore require consideration of the comparability of the underlying data.

[47] By introducing new methodologies, the Agency cannot modify the overall cost level that is embedded in the VRCPI. However, the CTA requires the Agency, relying on the information and methods it judges to be the most appropriate at the time of making its determination, to produce, as noted above, a VRCPI, based on a value set at 1.0 in 2000-2001. This value reflects cost levels in that crop year of the Revenue Cap Program. Cost adjustments were subsequently made by the Agency when specifically mandated by Parliament, which added or subtracted values to the weights of the VRCPI, thus causing it to deviate from its original value of 1.0.

[48] In the Pension Decision, the Agency stated the following regarding chaining:

[163] Determinations of the LPI will be chained back to the 2002 base year, which was the last base year to employ single year indices. Specifically, the use of amortized funding payments in place of the GAAP expenses, and the change in methodology due to elimination of multi-year averaging, will result in an index series that deviates from the existing series, and a need to chain back to the existing series.

[164] The primary weights used to construct the VRCPI from its component indices (labour, fuel, material and other, investment, depreciation, etc.) are obtained from the relative proportions of each component in the railway companies’ total system costs. By using amortized funding payments in place of GAAP expenses for the pension costs, the relative proportion of labour in total costs may change because of the recent large funding deficit payments by both CN and CP. Currently the primary weights are based on CN and CP 2007 system costs. The Agency will redevelop new primary weights that reflect the change in pension costs.

[49] Accordingly, to preserve the comparability of the underlying data, the LPI was recalculated using the updated methods from 2002 to the present, and the weights were recalibrated in order to preserve the original value of 1.0 and the subsequent cost adjustment related to hopper car maintenance and Canadian Wheat Board hopper cars. This recalibration is referred to as chaining of the labour price index and primary weights in the VRCPI.

Overview of VRCPI changes for the next crop year

[50] The table below provides a summary of the changes for 2012-2013 VRCPI. The effects of the Cost of Capital Decision and the Pension Decision were isolated by comparing the VRCPI adopted in this Decision with the VRCPI that would have resulted from application of the 2011-2012 methodologies.

| Major Component | Effective Weight (%) | % Change |

|---|---|---|

| Railway Inflation based on 2011-2012 Methodologies | ||

| Labour | 30 | 2.5 |

| Fuel | 24 | 4.1 |

| Material | 33 | 2.1 |

| Cost of Capital | 11 | -14.6 |

| OtherNote 1 | -1 | 0.5 |

| Total weighted price changes 2012-2013 | 100 | 0.8 |

| Upward Revision to 2011-2012 VRCPI weighted price changes based on actual and up-dated forecasted data. | 0.8 | |

| Total general inflation since 2011-12 | 1.6 | |

| One-time Impact of New Methodologies | ||

| Cost of Capital Decision | 3.3 | |

| Pension Decision | 4.6 | |

| Total weighted price changes since 2011-2012 VRCPI Determination | 9.5 | |

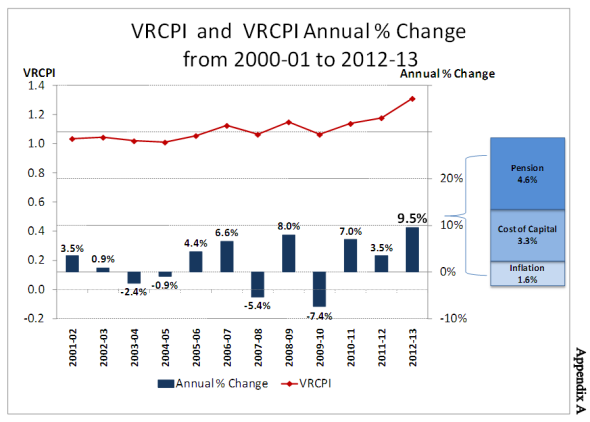

[51] This overall price increase is 9.5 percent. This increase can be attributed to the following:

General inflation with earlier methods

[52] The Agency has determined that the VRCPI would have increased by 1.6 percent in 2012-2013, had its 2011-2012 methodologies been applied.

Impact of the Cost of Capital Decision

[53] The impact of the Cost of Capital Decision on the VRCPI for 2012-2013 is 3.3 percent, reflecting essentially two factors: the recognition of the higher cost of financing equity in the U.S. and the establishment of the MRP based on a longer time period.

Impact of the Pension Decision

[54] The Agency decided in the Pension Decision to recognize current funding payments made by railway companies into their respective pension plans, direct railway company pension fund administrative expenses, the amortized portion of any statutory pension plan deficit payments over EARSL, as well as a cost of capital applicable to the unamortized portion of the pension asset. The effect of this decision is to increase the VRCPI in 2012-13 by 4.6 percent.

EVOLUTION OF THE VRCPI

[55] The graph in Appendix A illustrates the impact of the current VRCPI determination in the context of the evolution of the VRCPI since 2001-2002. It also illustrates the breakdown of the current VRCPI increase into its constituent components.

[56] The VRCPI has tracked up and down since the beginning of the Revenue Cap Program. In recent years, exceptional fluctuations have reflected the volatility of fuel prices, the hopper car adjustment in 2007-2008 and, this year, the new methodologies to better recognize the cost of capital and the effect on the labour price index of the substantial payments made by CN and CP to their pension funds. The VRCPI has grown at an average annual rate of 2.1 percent over the 2000-2001 to 2012-2013 period.

AGENCY DECISION

[57] The Agency's determination of the VRCPI for 2012-2013 is 1.2895, an increase of 9.5 percent from 2011-2012.

[58] The VRCPI of 1.2895 will be applied in the legislative formula under section 151 of the CTA when the Agency makes its revenue cap determinations by December 31, 2013 for 2012-2013.

APPENDIX A

Figure 1 - Text version: 2012–2013 Allocation of Financial Resources by Program Activity

Notes

- Note 1

-

Other consists of Leased hopper cars, Amortization, Cost of CWB cars, Embedded cost for hopper car maintenance and 2007-2008 Actual costs for hopper car maintenance.

Member(s)

- Date modified: